Imagine a solution provider that can help you deliver tools to retirement plan and wealth advisors. What if they could also help with data that informed your management and corporate strategy needs. FDI’s solutions will change the way you do business.

Deepen Relationships with DC Advisors

Asset Managers are looking for ways to add value and deepen relationships with DC Advisors. Fiduciary Decisions offers custom and off the shelf solutions that can help differentiate your firm and open more opportunities.

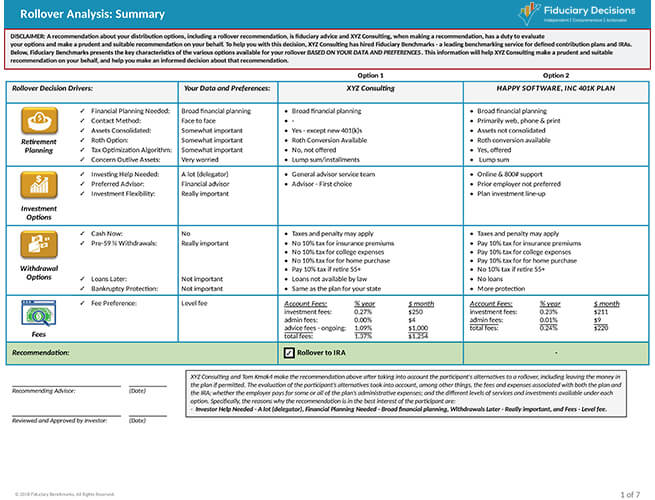

The Fiduciary Rule and RegBi are requiring advisors to follow a best interest standard of care. Fiduciary Decisions’ Best Interest solution will help advisor’s comply with standard of care best practices and produce a client-friendly report that documents your best interest IRA rollover recommendation. Sit down with your advisor relationships, walk them through the best interest process and help your Wealth Management and IRA Specialist advisors win more business.

Learn MoreResearch and Insights

Access FDI’s independent and actionable thought leadership. Subscription, topical studies, and custom reports designed to deliver the information and insights Asset Managers need to make informed business decisions. Develop product and pricing structures.

FDI can draw upon it's dataset of over 300,000 plans to produce investment line-up research in terms of construct, product usage, asset allocation and more. Also available is data and analytics on expense ratios and/or fee offsets and how they are being utilized to pay expenses and/or rebated.

Learn MoreLooking for insights into the competition, assistance with pricing strategy or where opportunity might exist? Leverage FDI's Research Team for our unparalleled data and industry expertise.

Learn MoreAnd there is so much more! Schedule a demo to see how the FDI Asset Manager solutions can change your business now.