What Factors Impact Retirement Income the Most, and Which Factors Impact it the Least

by Tom Kmak, Chief Executive Officer

Dec 28, 2023

During the last 15 years, our industry has seen an unprecedented amount of focus on the reasonableness of fees in 401(k) plans. While such focus is required of every fiduciary for every service provider that is paid from plan assets, it is important to note that the DOL admonishes fiduciaries to “not consider fees in a vacuum.” Why is that? Because the DOL smartly understands what truly impacts retirement income.

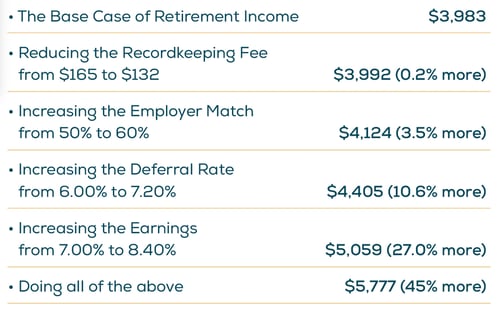

The simple calculation below shows that deferral rates, employer match rates and plan performance have the greatest impact on retirement income, and that changes in retirement plan fees have the least—even if they are decreased by 20%.

An Illustration Helps Make This Point Clear: Fees Have Little Impact on Retirement Income

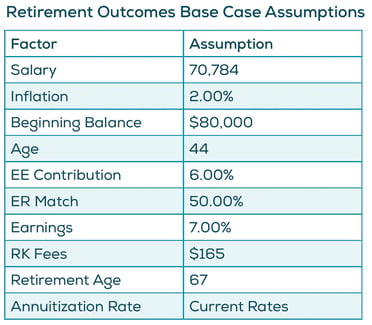

Let’s start with assumptions of a somewhat typical (but hypothetical) employee with an employer-sponsored retirement plan:

We’ll also assume a 2% annual increase for inflation. With these assumptions, simple mathematical projections show a retirement income beginning at $3,983 per month.

We’ll also assume a 2% annual increase for inflation. With these assumptions, simple mathematical projections show a retirement income beginning at $3,983 per month.

![]() Popularized by Mark Twain, as the famous saying goes, “numbers don’t lie.”

Popularized by Mark Twain, as the famous saying goes, “numbers don’t lie.”

Now, let’s go a step further and conduct a sensitivity analysis (a mathematical approach for determining the most impactful item) where we change some variables by the same percentage, in this case 20%. We’ll apply a 20% change to each factor, to determine which variable has the largest impact on this participant’s retirement.

![]()

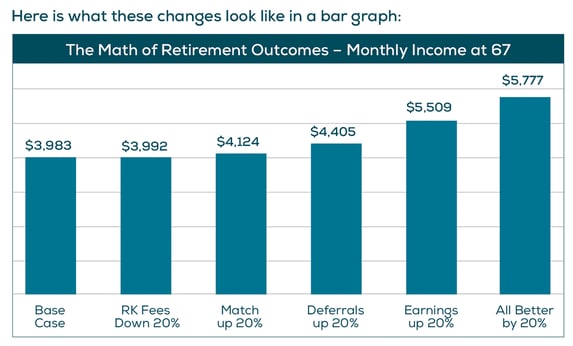

The Bottom Line: While Fees Are Important, Other Factors Drive Retirement Outcomes

The biggest drivers of increased retirement income, as shown in the bar graph illustration above, are the deferral rate, the employer match and the investment performance. Mathematically, even a 20% reduction in fees will likely have a minor impact on the retirement outcomes of participants.

The retirement plan industry would be much better served by focusing on better saving, investing and spending behavior. And that is why Fiduciary Decisions includes the Magnificent Seven as part of our reports for plan fiduciaries.

We Can Help

Please share this Impact of Key Metrics on Retirement Income supplement with plan sponsors, plan advisors and others to encourage them to help retirement plan participants reach their goals.

About Author:

Tom Kmak, Chief Executive Officer

Tom Kmak is the co-founder and Chief Executive Officer of Fiduciary Decisions (FDI, formerly Fiduciary Benchmarks). During his 16 years with the firm, FDI has become the industry’s leading firm for benchmarking retirement plans using a patented approach that recognizes the mathematical truth that “Fees Without Value is a Meaningless Comparison.” Tom is pleased to say that FDI’s benchmarking service is used by 70% of the largest and most prestigious Recordkeepers as well as over 60% of the best Retirement Plan Advisors as recognized by various industry publications. Tom has also been involved in the development of other services at Fiduciary Decisions, such as the Rollover Decision Support System supporting DOL PTE 2020-02, as well as the interactive plan design tool called the Retirement Outcomes Evaluator.

Prior to founding FDI, in 1990 Tom started the JPMorgan Retirement Plan Services business with American Century. Upon leaving in October 2007, that business employed 1,100 people serving two hundred large plan sponsors with over 1.5 million participants and more than $115 billion in assets. During his career with Retirement Plan Services, the company initiated numerous industry firsts including no blackout conversions and the innovative employee education program, Audience of One. Tom also served on the Executive Committee for JPMorgan’s asset management business.

Tom graduated Phi Beta Kappa from DePauw University with B.A. degrees in Economics and Computational Mathematics. He was the first graduate of the Management Fellows Program and a 3-year letterman in inter-collegiate basketball.