DC Benchmarking Services

Service Providers and Plan Sponsors need to work together to determine fee reasonableness and to produce optimal retirement outcomes for participants.

Fiduciary Decisions believes that certain aspects of benchmarking are “non-negotiable” as Plan Fiduciaries are required to ensure that they are “paying only reasonable plan expenses”. So, what do we think a responsible Fiduciary should focus on?

Use the Right Data

All of Fiduciary Decisions’ data is obtained directly from the source – the Recordkeepers, TPAs and Advisor/Consultants that charge the fees and provide the services. The data is less than 90 days old when received and is thoroughly screened for accuracy. The comprehensive dataset includes quality, service, value, extra credit items and fees.

Apply an Expert Method

Fiduciary Decisions' proven method focuses on building apples-to-apples benchmark groups of similar plans by service provider, using high-quality data and providing a balanced assessment of the relationship between value and fees.

Consider the Best Information

Fiduciary Decisions' reports are designed to be simple, transparent and practical. The reports provide concise information and actionable intelligence that support sensible decision making. The reports and the review process are part of a prudent review of fee reasonableness that is required under ERISA.

With that said, we realize that Plan Fiduciaries may have different approaches to satisfying their obligations so we have developed two different reports that adhere to our patented method and support a prudent process while allowing for differences in scope and time.

Our Benchmarking Services

Value and Fee Benchmark Report with FEEPOINT® Calculation

Our most detailed report includes plan-specific value and fee benchmarking by service provider. This report is available for the plan or for the individual service provider (Recordkeeper, TPA, Investment Manager and Advisor/Consultant).

Presentation Style - Value and Fee Benchmark Report with FEEPOINT® Calculation

This report is delivered in two PDFs – a committee ready presentation and a second document with all of the calculations and details. It includes plan-specific value and fee benchmarking by service provider. This report is available for the plan or for the individual service provider (Recordkeeper, TPA, Investment Manager and Advisor/Consultant).

Each chapter follows a simple 5-step method for assessing fee reasonableness as follows:

Customize Benchmark Group

Consider the Quality of your Service Providers

Analyze the Scope of Services and their impact on Plan Costs

Assess Value Delivered to the Plan Sponsor and their Participants

Examine Fees including “Extra Credit” items

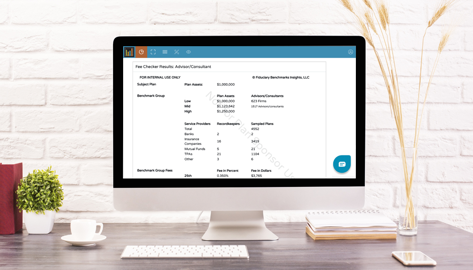

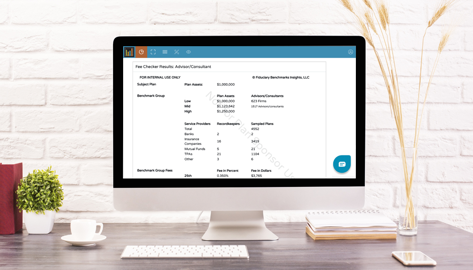

FeeChecker™

This service is intended for service providers for fee and service research as well as a “book of business” analysis. It can provide specific plan size data or analyze all of the plans in your firm from a value and fee standpoint to determine where you need to focus your efforts.

Read More

FeeBuilder

This service is intended for service providers and can communicate to both clients and prospects on a single page a snapshot of fee reasonableness. It includes benchmark group comparisons as well as FEEPOINT® adjustments and can be created on-demand in just minutes.

Read More

Request an Appointment

Speak with a Fiduciary Decisions Sales Consultant to learn which service will best fit your needs.