SEC RegBI and DOL PTE 2020-02 Rollover Recommendation Solutions –

Enable your advisors to always act in the best interest of their clients.

Rollover Decision

Support Systems

Compliance requires a series of specific actions when making recommendations for IRA transfers and plan rollovers. These actions apply to each recommendation made, must be documented and shared with the investor, and audited on an annual basis in order to comply. In terms of reach, these rules are impacting nearly every firm in the wealth management space driving the need for new technology solutions.

The 5-step best interest process required by the DOL to make a rollover recommendation

✓ Information about the participant’s investment profile (i.e., the “relevant” information about the participant);

✓ Information about the plan’s investments, services and expenses;

✓ Information about the potential IRA’s investments, services and expenses;

✓ A best interest analysis of the plan and IRA information in light of the participant’s profile; and

✓ The specific reasons, in writing, why the rollover recommendation is in the best interest of the participant.

Regulation Drives Change

Fiduciary Decisions offers you a pathway to compliance that is also easy and intuitive for your advisors.

We do this through the platform to analyze, document, and provide a compliant rollover recommendation

report to use with your clients. Using technology, data, and exceptional customer service we:

✓ Document the needs of your client

✓ Identify and document current account

✓ We provide a thorough analysis of your services and fees

✓ We produce a rollover recommendation report that can be tailored to your organization (your logo, additional disclosures, form CRS.

✓ Compliance and audit reports for retrospective annual reviews

Rollover Decision Support System

What We Do

Overview of the services we offer:

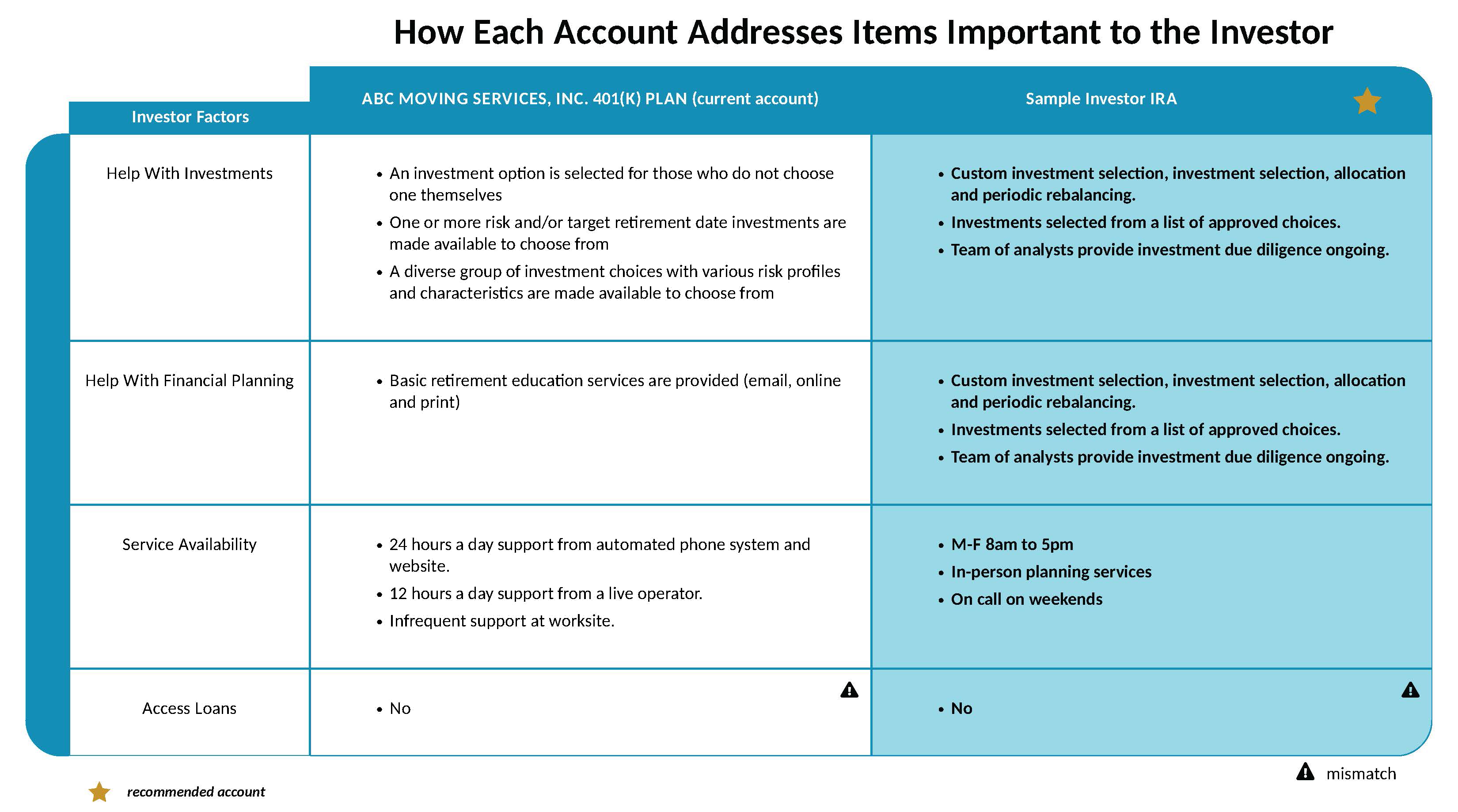

Best in class tool to analyze the needs and preferences of your client with easy-to-use client output.

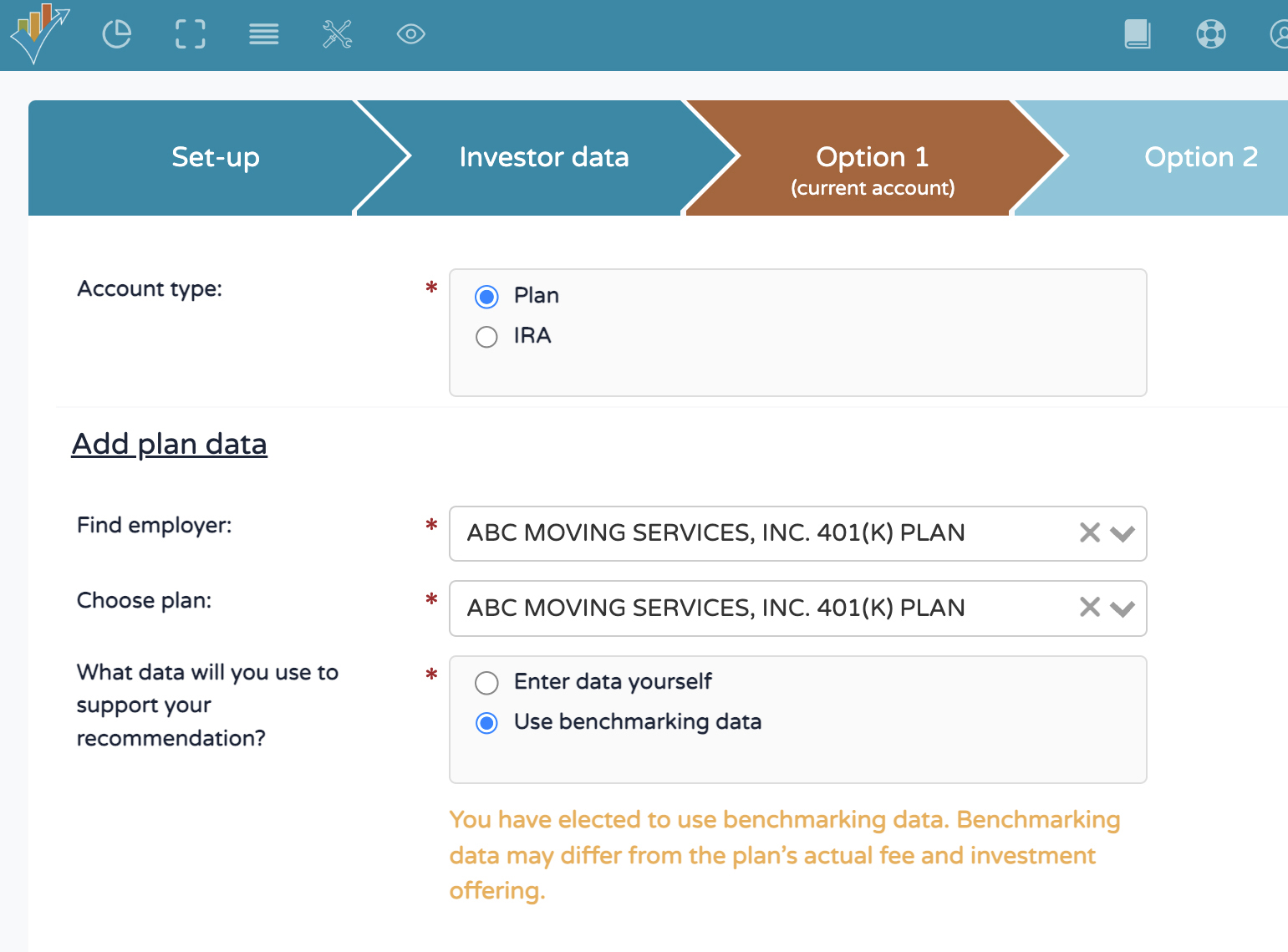

Use our system to search for Retirement Plans and add details. Benchmarking data also available if needed. For IRA transfers, our system offers an investment search/fee entry capability which helps you define the current account in support of your recommendation.

We gather data from your client or leverage FDI’s industry leading benchmarking data and methodology for use in the analysis. In addition, our solution enables you to describe in detail your services.

Our tool provides a framework for you to recommend the best path forward for your client and provides the supporting information for the recommendation.

Retrospective Annual Review

On-demand and annual compliance and audit tools

WHY RDSS IS RIGHT FOR YOU

Rollover Basics

Under SEC Reg BI and DOL PTE 2020-02

The Key Steps for Compliance:

✓ Reg BI

✓ PTE 2020-02

RDSS Helps You Comply:

Easy to use tool to analyze your clients’ needs and preferences when assessing potential rollovers from retirement plans or other IRAs to your firm.

✓ Reg BI

✓ PTE 2020-02

RDSS Helps You Comply:

For prior retirement plan information, utilize our easy-input tool to document actual fees, or leverage our patented benchmarking process for data.

✓ Reg BI

✓ PTE 2020-02

RDSS Helps You Comply:

During the analysis, leverage FDI’s solution to describe in detail your IRA services and fees.

✓ Reg BI

✓ PTE 2020-02

RDSS Helps You Comply:

RDSS presents summary analysis for internal review prior to making recommendation.

ø Reg BI

✓ PTE 2020-02

RDSS Helps You Comply:

Compliant client output tailored to your firm. Incorporate your branding, firm disclosures, and form CRS (optional) to deliver the required disclosure to your clients.

ø Reg BI

✓ PTE 2020-02

RDSS Helps You Comply:

Retrospective Annual Review: All data and client output is stored indefinitely and incorporated into a simple, year-end compliance file to facilitate audit requirements.