Imagine a single solution provider that can address the needs of your rep’s that need IRA Rollover tools as well as your rep’s that do qualified plan business – FDI’s IRA Best Interest Solution and Business Management Dashboard will change the way you do business.

New IRA Rules Driven by Regulation and Best Practices

The Fiduciary Rule and RegBi are requiring reps to follow a best interest standard of care. FINRA 13-45 (December 2013) dictated financial firm’s responsibilities when recommending a rollover or transfer of assets from an IRA to a qualified plan. Also, they provided guidance on how IRAs are marketed.

More importantly, doing the right thing is now table stakes and clearly a best practice.

Evaluate IRA Rollover Compliance

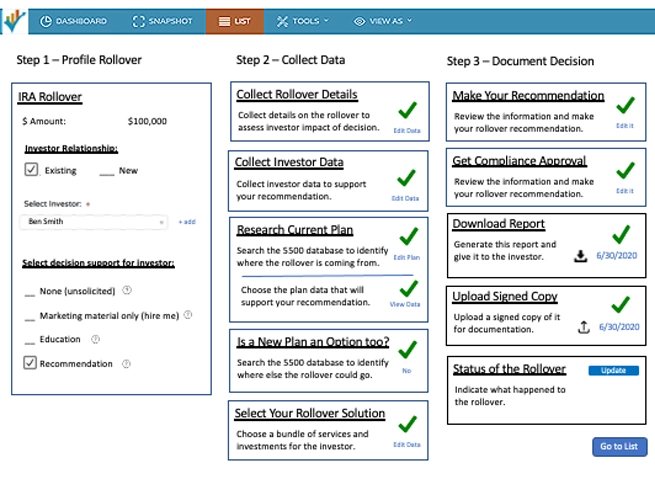

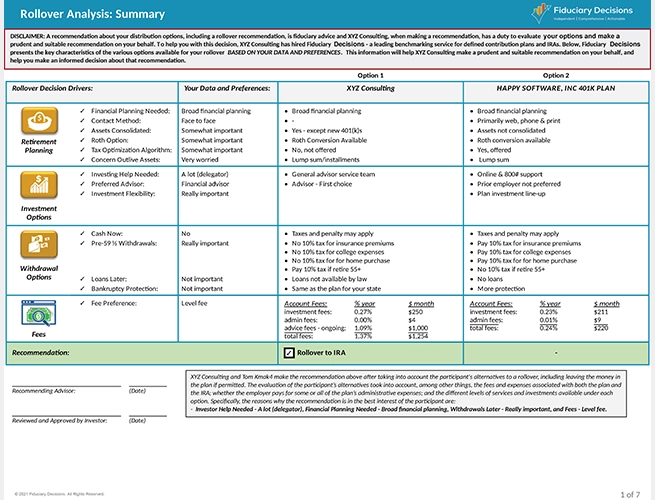

Every client is different and your rollover process should adjust to fit the client’s needs while maintaining the required compliance structure. FDI’s Best Interest Determination solution addresses the four types of rollovers: recommendation, education, hire me and unsolicited..

Document and Report Best Interest Recommendations

Gather the right data from IRA clients by using FDI’s Best Interest solution. Follow a process that is consistent, compliant and proven. Help your reps leverage templates and workflows for efficiency. Increase results at the Point of Sale. FDI’s solution will mitigate your bank’s risk exposure, protect your reps, help IRA clients make informed decisions and improve your bottom line.

Simplified Sales Management

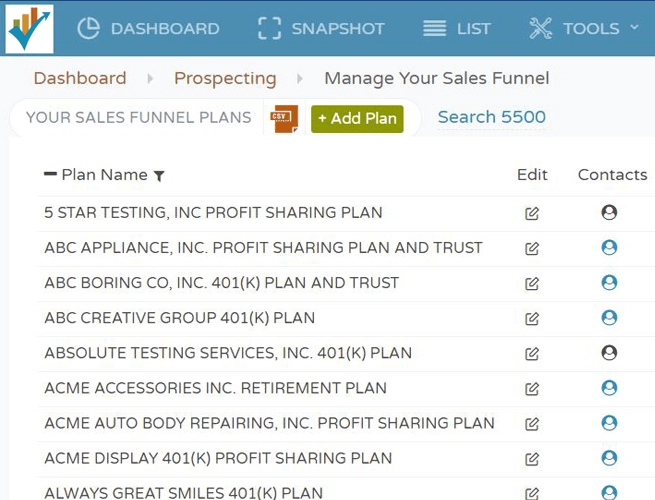

See your rep’s aggregate sales opportunities in a consolidated sales funnel. Provide your reps with powerful reports that will spark consultative meetings using Plan Profile. Support best business practices with workflows to move suspects to prospects to clients. Help your rep’s sell more efficiently and effectively than ever before.

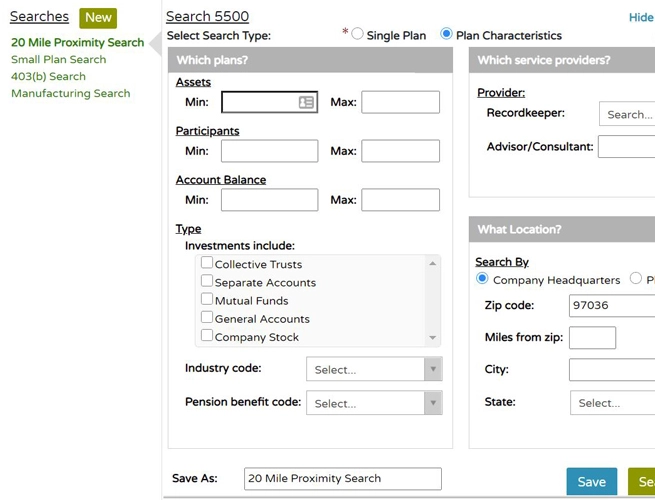

Use FDI's proprietary Identify - Engage - Close - Secure workflow to move suspects to prospects to clients. See your aggregate sales opportunity in your Prospect List. Add to your pipeline using FDI's 5500 Search. Have consultative initial meetings using our Plan Profile report and close new business with FeeBuilder.

Learn MoreThe Sales Funnel is where your advisors can manage the details of their sales efforts. Set plans as suspects or prospects, see the median compensation for plans of similar size based on FDI's data or set a custom fee and click to see the details for any plan. The Pipeline is where they can see their aggregate compensation opportunity and closed business. The Home Office view allows you to see aggregate or filtered datasets.

Too Many Tools, Too Little Time!

FDI's Business Management Dashboard is an open architecture solution which means that almost any tool/service can be integrated.** The possibilities are endless. Want to share data with your CRM - integrate it. Want to quickly see and or access your Investment Analytics without an additional login - integrate it. Want to quickly learn the status of your RFPs - integrate it.

Integration is defined as single sign-on access to a third party tool/service as well as the potential for real-time data exchange.

**FDI will integrate with third party service providers using FDI's APIs where applicable and reasonable.

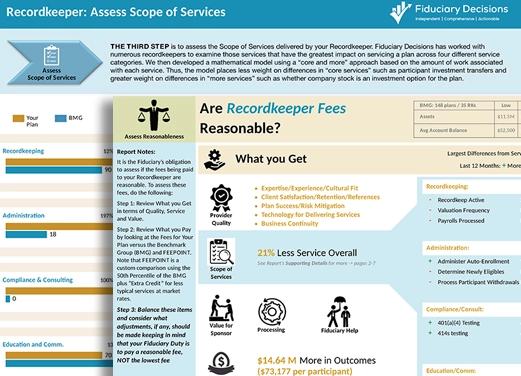

Value and Fee Benchmarking

FDI’s industry leading benchmarking is included and unlimited within the Business Management Dashboard. The enhanced user interface allows rep’s to quickly benchmark their practice, schedule reports and manage against best practices.

Bank Services

| Goals | |||

| Practice Management | Protect Plan Sponsors | Improve Participant Outcomes | |

|

Business Management Dashboard (Qualified Plan Business) |

|||

And there is so much more! Schedule a demo to see how the FDI’s IRA Rollover Best Interest solution and Business Management Dashboard can enhance your bank’s business now.